PhilHealth Contribution Calculator

Calculate your estimated PhilHealth contribution based on the latest premium rate.

Use this PhilHealth Contribution Calculator to estimate your monthly PhilHealth contribution.

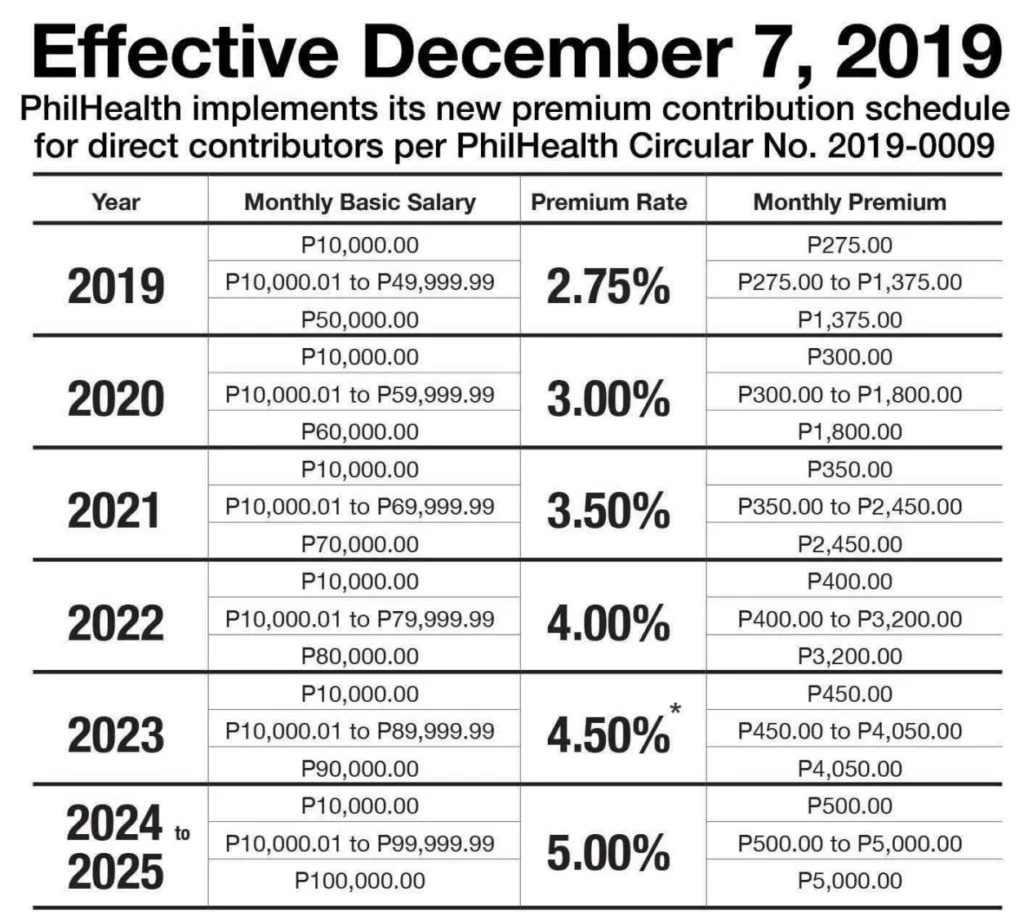

Based on the latest PhilHealth Contribution Table 2025, we have calculated the correct results for you.

PhilHealth Contribution Calculator Instructions

You can manually compute your PhilHealth contribution by using PhilHealth’s easy-to-understand contribution table.

This PhilHealth Contribution Calculator, however, will give you a quick answer. Here’s how to use it:

- This tool requires that you enter your Monthly Salary as the first input.

- There are two types of memberships available: Employed and Self-Employed/Individual.

- The results can then be obtained by clicking the blue Calculate button.

Results of the PhilHealth Contribution Calculator

Calculator computation results are displayed in the lower part of the tool called Computation Results.

Depending on whether you are employed or not, the first output will reflect your employer’s share.

You’ll then see the Employee’s Share, which will not apply if you’re an individual payer.

Finally, you should see the Total Contribution, which should be the total amount you will pay to PhilHealth as an employee or individual member.

Contribution computation for PhilHealth

You will split the payment with your employer 50/50 if you are an employee, which means that your contribution would be ₱750 if your salary is ₱15,000.

Employers are required to pay half of this tax, which is ₱375. You will also have to pay ₱375. It is typically deducted from your gross pay before the end of the month.

Alternatively, if you are self-employed or paying individually, you must contribute 100% of your income based on your contribution amount. If you earn ₱25,000 a month, your contribution is ₱1250.

PhilHealth’s Contribution in Detail

In order to fully understand your PhilHealth premium, you’ll need to understand the mechanics behind the calculations. The official rate for 2025 will be 5% of your basic monthly salary. In terms of the computation base, there are certain rules that must be followed.

Monthly Premiums: An Overview

You have to pay a monthly premium based on your monthly basic salary, but there is a maximum and minimum cap. If your salary is below the monthly income floor of ₱10,000, your premium will be calculated based on this amount. In contrast, if your monthly salary exceeds PhilHealth’s premium ceiling of ₱100,000, your premium is calculated based on this amount. This ensures that even minimum wage earners contribute to the fund. By introducing a progressive approach to taxation, higher-income earners are able to contribute more, but at a capped rate, maintaining an overall sense of equity.

Contributions to PhilHealth: How to Calculate

In the case of employed individuals, the 5% premium is divided equally between the employee and the employer when calculating PhilHealth contributions. In the case of self-employed individuals and voluntary members, every member is responsible for paying the entire 5% premium. Employers deduct 2.5% from the employee’s salary and remit it along with their own 2.5% share to PhilHealth. Calculators take care of this by automatically applying the appropriate percentage based on the type of membership you select. In order to make this distinction, you should search for a specific philhealth calculator rather than using a generic one, which is more effective.

Voluntary Contribution of PhilHealth

It is very similar to the PhilHealth voluntary contribution process. Your premium is based on your declared monthly income, subject to the same floor and ceiling. This type of arrangement is common among freelancers, entrepreneurs, and other individuals without traditional employers to share the cost of the 5% premium. It is important for these members to be able to understand their total financial obligation and plan their monthly payments accordingly with the help of a good calculator.