PhilHealth Contribution Table 2025

A new PhilHealth contribution table for 2025 has been released by the Philippine Health Insurance Corporation (PhilHealth). There should be an education campaign for the members regarding these new premium contribution amounts, especially for those who are employed, self-employed, overseas Filipino workers, and sponsored members.

Most Filipino citizens are aware that PhilHealth provides outstanding medical benefits to its members, which is a great help when medical assistance is required. There is no way to know when you will need PhilHealth’s benefits the most if you don’t pay your monthly premiums.

The PhilHealth Contribution Table for Employed Members below shows the Total Monthly Premium based on a fraction of monthly salary range.

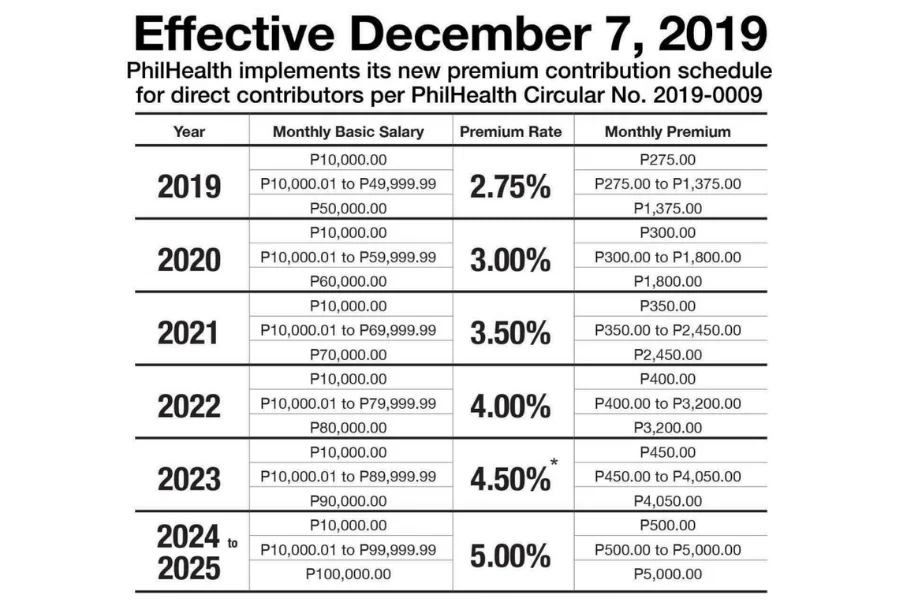

A revised PhilHealth Contribution Table for 2025 has been released

From January 2025, the premium rate will be 5.0% of the member’s basic salary or declared income, with a ceiling of ₱100,000 and a floor of ₱10,000. As a result of this adjustment, healthcare is expected to become more accessible to more people, while still ensuring that different income levels have equal contributions.

You Can Check: PhilHealth Contribution Calculator

1. Employees (private and public)

- The employee’s basic salary will be contributed at a rate of 5.0%

- The salary floor is ₱10,000

- The salary ceiling is ₱100,000

- Method of computation:

- Salary determines the total monthly premium.

- Contributions are equally shared between the employer and employee (50% each).

| Basic Salary per month | Premiums paid monthly | Shares of employee profits | The employer’s share |

| ₱10,000 and below | ₱500 | ₱250 | ₱250 |

| ₱20,000 | ₱1,000 | ₱500 | ₱500 |

| ₱50,000 | ₱2,500 | ₱1,250 | ₱1,250 |

| ₱100,000 and above | ₱5,000 | ₱2,500 | ₱2,500 |

2. Members in their own right, volunteers, and professionals

- The contribution rate is 5.0% of the declared monthly income

- The income floor is ₱10,000

- The income ceiling is ₱100,000

- Method of computation:

- A member’s monthly contribution is determined by his or her declared income for the month.

- The individual pays the entire contribution.

| Income per month | Premiums paid monthly |

| ₱10,000 and below | ₱500 |

| ₱20,000 | ₱1,000 |

| ₱50,000 | ₱2,500 |

| ₱100,000 and above | ₱5,000 |

3. Filipinos who work overseas (OFWs)

- Rate of contribution: 5.0% of monthly income or ₱10,000 (whichever is greater).

- Depending on income, the annual premium ranges between ₱12,000 and ₱60,000.

- Options for payment:

- It is possible for OFWs to pay their contributions annually or semi-annually through accredited payment centers, such as overseas remittance centers, banks, and e-wallets affiliated with PhilHealth.

4. Household workers (Kasambahays)

- The contribution rate is 5.0% of the monthly salary

- Responsibilities of the employer:

- A kasambahay’s monthly salary of ₱5,000 or less is covered by the employer in full.

| Salary per month | A monthly subscription fee | Share of employers | Share the Kasambahay |

| ₱5,000 and below | ₱250 | ₱250 | ₱0 |

| ₱10,000 | ₱500 | ₱250 | ₱250 |

5. The elderly

- Contributions to the premium:

- Senior citizens are automatically enrolled into PhilHealth’s program under Republic Act No. 10645, which does not require them to pay any premiums.

6. Members who are lifetime members

- Contributions to premium accounts:

- Once members have made at least 120 months of contributions during their working years, they do not need to make any further contributions.

7. Indigents and Sponsored Members

- Contributions to Premiums:

- Under the National Health Insurance Program (NHIP), government subsidies pay for all premiums.

Deadlines for making payments

Members are encouraged to adhere to the following schedules for paying contributions to ensure uninterrupted access to PhilHealth services:

- Members who are employed:

- The employer must remit the contributions by the end of the following month.

- Members who work on their own, volunteers, and professionals:

- In most cases, quarterly payments are due on the last working day of the quarter (for example, March 31, June 30, September 30, and December 31).

- Overseas Filipino Workers:

- Members can choose between annual and semi-annual payments according to their preferences.

PhilHealth Contribution Payments

The following methods are available to members for paying their contributions:

- Members who are employed:

- Employers automatically deduct contributions from employees’ salaries and remit them to PhilHealth.

- Members who are self-employed, voluntary, or professionals:

- Online platforms, payment centers, and banks are accredited collecting agents.

- Overseas Filipino Workers:

- A PhilHealth-accredited collecting agent abroad or an online payment option can be used to make contributions overseas.

- A Kasambahay:

- For household workers, employers are responsible for remitting contributions to PhilHealth.

Changes in PhilHealth contributions in 2025

In 2025, there will be the following significant updates:

- Contribution rate increased:

- According to the Universal Health Care Law, the premium rate has increased to 5.0% from 4.5%.

- The adjusted income floor and ceiling are as follows:

- To maintain equity among contributors, the income ceiling has been raised to ₱100,000 to accommodate higher-income earners.

- Coverage has been expanded:

- As a result of the updated rates, the additional funds will be used to expand access to healthcare, enhance members’ benefits, and enhance the quality of services.

Philippine Health Plan Contribution for Self-Employed Filipinos and Overseas Filipino Workers

Employed by yourself:

Premium contributions for Self-Employed Members earning less than ₱25,000 are ₱2,400, while they are ₱3,600.00 for Self-Employed Members earning more than ₱25,000 per month.

Filipinos working overseas:

It is the responsibility of Land-Based Overseas Filipino Workers to pay the premium contribution at the rate of ₱2400.00 every year. Contributions can also be paid in advance for a period of two to five years depending on the length of your contract abroad. According to the table above, Sea-Based Filipino Workers must pay salary-based rates following the premium contributions of Employed Members.

Members sponsored by:

Sponsored members are those whose premium contributions are being paid by someone else, either an individual, private organization, or government agency. The annual premium contribution is ₱2,400.

PhilHealth Contributions: Why It’s Important to Stay Up-to-Date

It is essential that you know what PhilHealth’s latest contribution rates are in order to ensure that you have continuous access to essential healthcare benefits, such as hospitalization and outpatient consultations. Failure to pay dues on time can result in the loss of membership status, resulting in denial of claims during times of need.

Keeping up to date with labor laws ensures compliance with labor laws and avoids penalties. Employers can foster a culture of responsibility and care in their organizations by remitting contributions on time.

Process Streamlining for Payroll and Contributions

Employee benefits and statutory contributions like PhilHealth can be complex, time-consuming, and error-prone. By automating these processes, you can save time, minimize errors, and ensure compliance.

Conclusion

The PhilHealth contribution table for 2025 underscores the government’s commitment to improving healthcare accessibility for all Filipinos. As members and employers, it is crucial to understand and comply with these updated rates to enjoy uninterrupted benefits and contribute to the country’s Universal Health Care goals.